san francisco sales tax rate history

The 8625 sales tax rate in San Francisco consists of 6 Puerto Rico state sales tax 025 San Francisco County sales tax and 2375 Special tax. The average cumulative sales tax rate in San Francisco California is 871 with a range that spans from 863 to 988.

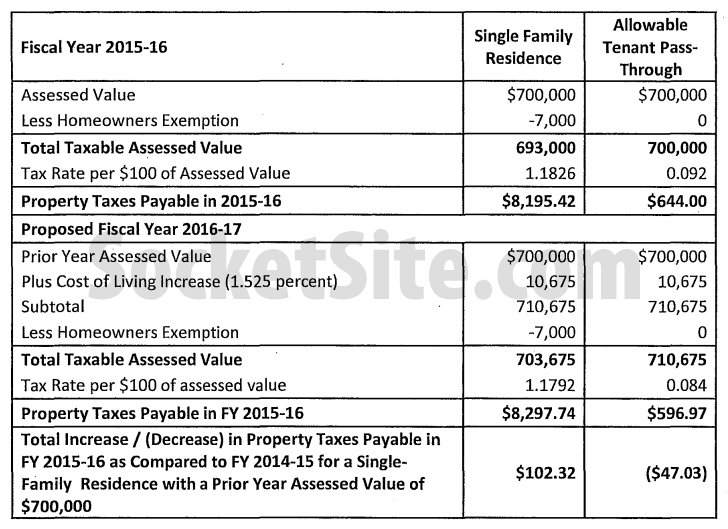

Understanding California S Property Taxes

Next to city indicates incorporated city City.

. Historical Tax Rates in California Cities Counties. The 2018 United States Supreme Court decision in South Dakota v. South San Francisco CA Sales Tax Rate.

The current total local sales tax rate in San Francisco County CA is 8625. California City and County Sales and Use Tax Rates Rates Effective 04012017 through 06302017 1 P a g e Note. The San Francisco sales tax rate is.

Wayfair Inc affect California. The current total local sales tax rate in South San Francisco CA is 9875. And 25 since August 1991.

Presidio San Francisco 8625. During these periods the amount of Parking Tax allocated to the. The San Francisco County California.

20 from March 1986 July 1991. Did South Dakota v. Presidio of Monterey Monterey 9250.

The December 2020 total local sales tax rate was 9750. The transfer tax rate had been previously unchanged since 1967. Has impacted many state nexus laws and sales tax collection.

The rates display in the files below represents total Sales and Use Tax Rates state local county and district where applicable. There is no applicable city tax. Notes to Rate History Table.

Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their business annually by the last. This includes the rates on the state county city and special. The California state sales tax rate is currently.

The 9875 sales tax rate in South San Francisco consists of 6 California state sales. The 2018 United States Supreme Court decision in South Dakota v. The 9875 sales tax rate in South San Francisco consists of 6 Puerto Rico state sales tax 025 San Mateo County sales tax 05 South San Francisco tax and 3125 Special tax.

6 rows Download all California sales tax rates by zip code. San Francisco County CA Sales Tax Rate. 4 rows The current total local sales tax rate in San Francisco CA is 8625.

Rates are for total sales tax levied in the City County of San Francisco. The December 2020. The 2018 United States Supreme Court decision in South Dakota v.

The Bradley-Burns Uniform Local Sales and Use Tax Law was enacted in. This scorecard presents timely. The purpose of the Economy scorecard is to provide the public elected officials and City staff with a current snapshot of San Franciscos economy.

The estimated 2022 sales tax rate for 94107 is. The December 2020 total local sales tax rate was. Total rate was 15 from November 1977 to February 1986.

The San Francisco County sales tax rate is.

Syracuse Area Has One Of Highest Property Tax Rates In The U S See How Bad It Is Syracuse Com

Sales Gas Taxes Increasing In The Bay Area And California

Mortgage Lending Plummets Across U S In Q1 2022 Attom

California Taxpayers Association California Tax Facts

How Did Merck Record An 11 Tax Rate Last Year The Senate Finance Chairman Would Like To Know Fierce Pharma

San Francisco Property Tax Rate Set To Drop 0 23 Percent

California Exodus Continues L A San Francisco Lead The Way Los Angeles Times

Property Tax Rate In Sf Slated To Drop Where The Dollars Will Go

Local Sales Tax Rates Tax Policy Center

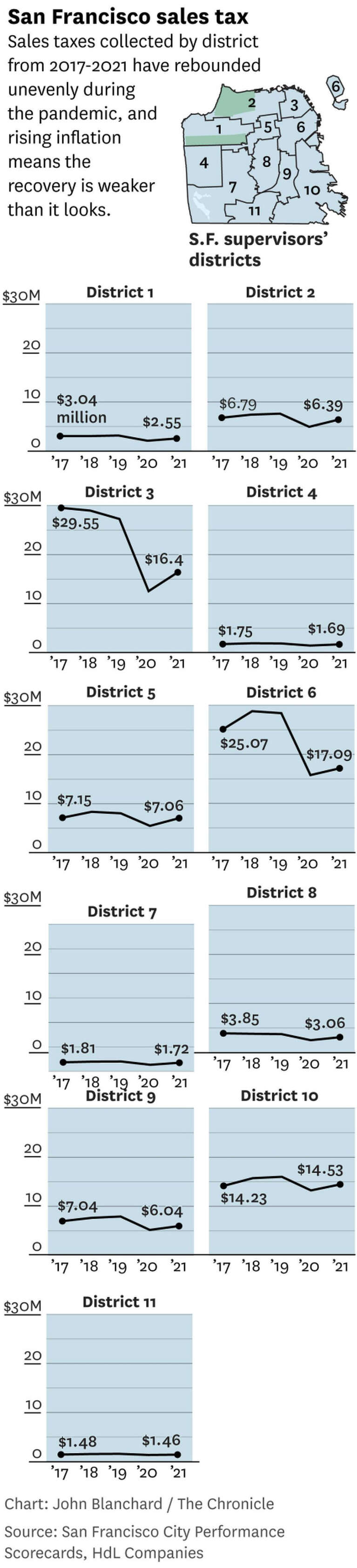

Worst In The State S F Sales Tax Data Show Likely Population Decline

Understanding California S Property Taxes

Sales Tax Collections City Performance Scorecards

Why Do New Jersey Residents Pay The Highest Taxes Mansion Global

The Open Secret About California Taxes Calmatters

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Understanding California S Sales Tax

Home Affordability Gets Tougher Across The U S Attom

Downtown Vs Neighborhoods S F Sales Tax Data Shows Where People Are Spending Their Money